Quarterly Business Update for three months ended 30th September 2021

HB Reavis has hereby published its Quarterly Business Update for three months ended on 30th of September 2021 and Financial Highlights for the first six months of the year ended on 30th of June 2021. You may read the full report below, or download the Quarterly Business Update in pdf here and the Interim Financial Statements here.

Peter Pecník, Group CFO, comments on the financial results for the six months ended on 30th June 2021:

“Implementation of nationwide restrictions in late 2020 and early 2021 and roll-out of vaccination in our countries of operations slowed down the spreading of Covid-19 pandemic and was critical in restoring social and economic activity. Increased business confidence in the cities where we operate underpinned the activity of office occupiers, which intensified their interest for premium workspaces.

We were able to achieve construction progress on all of our development sites, especially the Forest Campus, which has been completed in early 2021, as well as projects Nivy Mall, Bloom Clerkenwell, and DSTRCT.Berlin, with the former two having achieved completions by the time of this business update and the latter expecting completion by the end of this year.

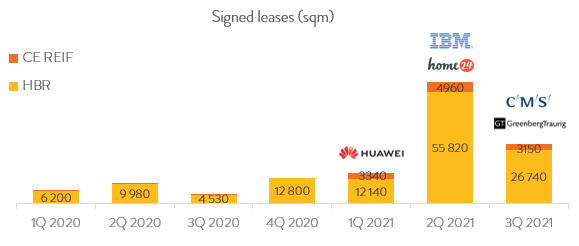

We have also recorded strong momentum on leasing markets across Europe with numerous sizeable deals signed during the first half of the year. Our leasing team was able to secure clients such as IBM with over 32 thousand sq m of GLA for New Apollo, our latest addition to construction portfolio and home24 with more than 13 thousand sq m for our DSTRCT.Berlin development. These factors positively contributed to the operating profit of €186.6 million for the first six months of the year, mainly influenced by revaluation gain achieved on investment properties of €191.7 million as well as foreign exchange gains of €19.1 million.

The revaluation gain was achieved by increase in market value of properties through combination of progress in construction as considerable capital expenditures have been invested into the projects (Varso Tower, Forest Tower) and individual projects approached their respective completion statuses (DSTRCT.Berlin, Nivy Mall, Bloom Clerkenwell), the commercialization of properties (DSTRCT.Berlin, Bloom Clerkenwell (Head of terms)), securing of final planning consents (One Waterloo) and changes in valuation method for properties reclassified into income producing portfolio (Forest Campus).

HB Reavis is subject to fluctuation in foreign exchange rates since the entities on UK, Czech, Polish, and Hungarian markets use local currencies for accounting purposes to record obligations and receivables which are contractually set out in EUR. The impact of these changes in foreign exchange was driven by appreciation of the foreign currencies against euro – 4,6% gain in GBP, 3,4% gain in HUF, and 2,9% gain in CZK.

In terms of the balance sheet strength, the company finished off the first half of the year with €203.0 million cash balance, total assets increased by €417.3 million to €3.51 billion with an increase in NAV from €1,513.8m to €1,713.9m. HB Reavis increased its level of debt to €1.60 billion with gross debt leverage of 45.6% and net debt leverage of 39.8%.”

Quarterly business update for three months ended on 30th September 2021

Acquisitions

The Group has finalized the acquisition of project New Apollo, currently under construction with expected practical completion to be reached in first half of 2023. As previously indicated IBM has become a core tenant for this project, taking over 30 thousand sq m of GLA. The Group has been finalizing acquisition of a land plot located in central Berlin.

Leasing update

Our leasing performance for the third quarter of 2021 was marked by conclusion of several deals on the Polish market as well as one deal signed in Berlin. Firstly, the project which is currently under construction is expected to reach its practical completion in the first half of the year 2022. Secondly, Nielsen, an information, data, and market measurement company, has signed 4 thousand sq m of GLA in our project Forest Campus. In Berlin, we signed WowTech Group for our DSTRCT.Berlin development with almost 3.3 thousand sq m of floor area. Our commercial activities for the third quarter of 2021 resulted in almost 27 thousand sq m of leases signed with an annual passing rent of almost €7.1 million. The above-mentioned contracts together with the performance in the first two quarters of the year brings our YTD signed leases to 95 thousand sq m of GLA and a passing rent of €22.7 million.

Completions and developments progress

During the third quarter of 2021 we achieved significant construction progress on all of our projects, where projects Nivy Mall and Bloom Clerkenwell reached practical completion. We have recently launched preparatory, and demolition works on project Worship Square, located in Shoreditch, which will bring 12 thousand sq m of premium workspaces and will involve also flexible office space, 625 sq m of retail and amenities, and 860 sq m of green terraces. Our project DSTRCT.Berlin has approached practical completion on the hall Neubau, which is expected to open its doors to tenants by the end of 2021.

Nivy Mall

We have opened the doors to Nivy Mall – a 102.3 thousand sq m urban-shaping project which combines retail space, leisure areas (with 550m long running track on the roof) with an international bus terminal. The project is currently contractually occupied at 90% of its capacity and during the first 24 days of operations attracted more than 1 million visitors. The opening marks completion of a development complex at Nivy – the above mentioned Nivy Mall as well as Nivy Tower – transforming the landscape of this business district and adding almost 135 thousand sq m of GLA of office, retail, leisure, and transportation space. The Nivy Zone has been awarded with BREEAM Communities at level excellent, ranking among the top 5 development complexes worldwide, which further underlies HB Reavis‘ ESG focus.

Bloom Clerkenwell

Our over-the-station development at Farringdon has reached practical completion and obtained occupancy permit at the end of August 2021. Bloom Clerkenwell combines 13.3 thousand sq m of office, retail, and amenity space, all located at intersection of Crossrail, three underground lines, and Thameslink – making Bloom one of the best-connected buildings in London. The project has already attracted significant commercial interest, resulting in a four-fifths of the floor area being under offer. The prospective tenants will, besides the above-mentioned benefits, enjoy space accredited by BREEAM Outstanding, WELL Platinum, and WiredScore Platinum with target of Net Zero Carbon in operation.

Financing

During the third quarter of 2021, HB Reavis has drawn down a total of €142.3 million of external debt financing, out of which €112.3 million was primarily linked to properties currently under construction and €30.0 was linked to general corporate purposes. At the end of the quarter, the Group had €1.3 billion of bank financing along with €400.9 million of bond financing outstanding.

Divestments

As part of HB Reavis intensified focus on core location, the Group has divested its non-core project Kesmark, located in Budapest, Hungary. The project with 15 thousand sq m of GLA was divested to hands of private investor.

HB Reavis portfolio

Income producing portfolio

As of the end of the last quarter, the Group held a portfolio of 10 income producing office properties with a total of 367.3 thousand sq m across three countries with operating income at full occupancy of €89.9 million. The portfolio includes the following projects:

- Agora Tower and Agora Hub in Budapest, Hungary

- Nivy Mall, Nivy Tower, Apollo BC II in Bratislava, Slovakia

- Varso 1, Varso 2, Forest Campus in Warsaw, Poland

- Bloom Clerkenwell in London, UK

The overall market value of the portfolio totaled up to €1.47 billion as of 30th June 2021 based on management estimates, while the weighted average occupancy across the portfolio was 77% at the end of the last business quarter.

Projects under construction

Projects currently in the phase of construction (or demolition) account for 239.5 thousand sq m of future GLA in five buildings and estimated future gross development value of around €1.52 billion based on management estimates, all spread over four capital cities:

- DSTRCT.Berlin, Germany

- Varso Tower & Forest Tower in Warsaw, Poland

- New Apollo in Bratislava, Slovakia

- Worship Square in London, UK